Proper tax planning and implementation are important components of a

successful financial plan. With the help of Tim Edworthy, this

instalment of Financial Adjustments focuses on professional

corporations, and on strategies to reduce taxes and increase your

wealth.

Proper tax planning and implementation are important components of a successful financial plan. With the help of Tim Edworthy, this instalment of Financial Adjustments focuses on professional corporations, and on strategies to reduce taxes and increase your wealth.

In the past several years, every province has enacted legislation that allows

professionals to incorporate. For chiropractors, the legislation permits only the professional to own any class of shares of his or her professional corporation (PC). As a result, many traditional tax benefits related to the operation of a private company are generally unavailable. However, advance planning may create income-splitting opportunities for the professional and family members. This article outlines the benefits and issues related to the use of a PC by a chiropractor for the operation of a business. The ability to incorporate is available to chiropractors in all provinces.

A PC can provide several potential tax-deferral and tax-saving opportunities. In conjunction with the implementation of an individual pension plan (IPP) and/or a retirement compensation arrangement (RCA), a PC can be an alternative retirement savings vehicle for the individual who does not require all his or her income for living purposes.

LEGAL CONSIDERATIONS

Because PCs are governed by specific provincial legislation, they are subject to unique corporate law issues. Unlike typical corporations, PCs generally do not protect their shareholders from professional malpractice claims against the corporation. However, the professional may be able to achieve some level of protection (e.g., in respect of trade payables, lease liabilities, bank loans) for liabilities not covered by his or her personal guarantee.

Provincial legislation requires that the majority of directors of the chiropractic PC themselves be professionals licensed under the relevant provincial governing body. Additionally, the legislation generally precludes indirect share ownership of the chiropractic PC.

BENEFITS OF INCORPORATION

The primary benefits of incorporation of a chiropractic professional practice are the tax advantages available to a corporation. Incorporation may also offer some compensation flexibility and facilitate access to the capital gains exemption.

Low corporate tax rates

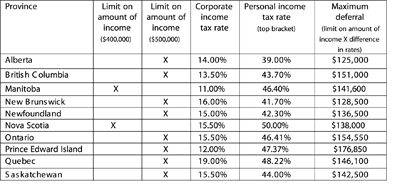

Setting up a PC allows significant amounts of tax to be deferred. The corporation retains the income, paying tax at relatively low corporate rates. As the table below shows, for the calendar year 2011, all provinces provide a low rate of tax on the first $400,000 to $500,000 of active business income earned by a corporation. Maximum deferrals range from $125,000 to $176,850, depending on the province.

This is calculated as the $400,000 to $500,000 limit multiplied by the difference between the personal rate at which the professional would have paid tax and the corporate rates at which the PC pays.

The deferral advantage is available only while the corporation retains the funds. When the PC distributes the funds, the recipient will be subject to personal tax. If the professional needs all of the corporate funds every year, the tax deferral will largely be lost.

Alternative retirement investment vehicle

As noted in the table on page 19, the corporate tax rates for PCs range from a low of 11 per cent to a high of 19 per cent dependent on province. Based on the same amount of taxable income, the after-tax funds retained by a PC provide a greater pool of funds for investment purposes compared to the after-tax funds available to an unincorporated professional.

|

|

The after-tax funds of the PC can be used for investment purposes (e.g., equities, bonds, real estate, life insurance) to build the wealth of the professional. Those funds invested in permanent life insurance can generally be paid out on a tax-free basis by the PC to its shareholder(s), subsequent to the receipt of the life insurance proceeds, as a capital dividend. Capital dividends are not considered to be a taxable amount for the recipient.

Income splitting

Legislation in all provinces precludes non-professionals from becoming shareholders (i.e., family members, holding companies and family trusts) of a chiropractic PC. This legislative issue generally precludes the possibility of splitting dividend income from the PC with family members. However, there are advanced structuring techniques that may be implemented to facilitate dividend income splitting with family members via the use of a holding company and/or a family trust.

Splitting dividend income with family members can reduce the overall tax burden for the family. In order for this to work the recipients must generally be the spouse or majority aged children of the shareholder and be in lower tax brackets. As noted above, since non-professional shareholders are precluded from owning shares of a chiropractic PC, planning will be required in order to achieve dividend income splitting with respect to the chiropractor’s family members. Family members may also be employees of the PC and receive reasonable salaries for services that they provide. An employees’ profit-sharing plan trust might also be considered as a way to split income with those family members.

Asset protection

Although non-professional shareholders are precluded from holding shares of a chiropractic PC, there are planning arrangements that may allow the professional the ability to protect some non-business assets. Transferring excess capital to a holding company should protect these assets of the PC from business risks associated with the operation of the chiropractic practice.

Remuneration flexibility

Having a PC gives the chiropractor the choice of receiving remuneration as salary or as dividends. Several factors should be considered in determining the appropriate mix. For example, the professional may choose to receive sufficient compensation as salary to ensure that the maximum annual contribution to a Registered Retirement Savings Plan (RRSP) and Canada Pension Plan (CPP), or Quebec Pension Plan (QPP), can be made.

As well, a corporation may allow a professional to increase his or her personal retirement savings by making tax-deductible payments to an individual pension plan or retirement compensation arrangement.

$750,000 capital gains exemption

An individual shareholder may be able to use his or her personal capital gains exemption upon disposition of shares of the chiropractic PC. Before selling shares, their eligibility for the capital gains exemption will need to be determined. However, share sales can be difficult from a practical perspective, because purchasers typically prefer to acquire assets of the corporation.

SUMMARY

The legislation permitting chiropractors to incorporate has remained relatively unchanged since its introduction. Non-professional shareholders are precluded from owning shares of a chiropractic PC. However, there are planning arrangements that may be implemented to facilitate income splitting and asset protection of a chiropractic PC.

Advanced structuring and the existing legislation allow chiropractors to take advantage of benefits – tax and otherwise – like those available to other self-employed individuals who can operate their businesses through a corporation.

For a chiropractor, the low corporate tax rate, retirement planning strategies, remuneration flexibility, potential income splitting and asset protection, and the opportunity to potentially utilize the capital gains exemption are all attractive benefits of incorporating. However, the appropriateness of the incorporation should be evaluated based on the specific situation of each individual professional.

Paul Philip, CFP, CLU, and Nancy Philip, CFP, CLU, are a dynamic

sibling team who have been advising hundreds of chiropractors across

Canada since 1992. Their firm, Financial Wealth Builders, is located in

Toronto, Ontario. To learn more about building your wealth, visit their

website at www.fwb-inc.com or contact Paul or Nancy at 416-497-0008.

Print this page