The ongoing volatile seesaw market of the past few years has made it

difficult for investors to navigate and effectively plan for their

retirement.

The ongoing volatile seesaw market of the past few years has made it difficult for investors to navigate and effectively plan for their retirement. The market outlook remains unknown, with challenges relating to the ongoing European debt saga, persistently low interest rates, higher inflation and anemic real economic growth. Further, the impending wave of baby boomers may pose a significant challenge to the sustainability of government-sponsored entitlement pensions. At best, the outlook remains questionable.

As a busy entrepreneur, running a successful incorporated practice, you have a unique opportunity to add an element of certainty to your overall financial picture.

While the future is inherently unpredictable, this article explores a strategy that can add a great deal of comfort and security to a well-rounded financial plan.

Meet Dr. Adam Just. He is the owner of Dr. A. Just Chiropractic and Wellness Clinic. Adam is married with two children. He has endured the market volatility and is keen to add an element of security to his retirement plan.

Like most business owners, Adam has worked hard and saved for retirement. His income consists of salary and an occasional dividend payable from the earnings inside his corporation. After paying his ongoing business expenses, Adam has excess cash that continues to accumulate inside the corporation, upon which he must declare and pay tax annually on the income earned.

Adam has been diligent in his retirement planning. He has maximized his RRSP contributions over the years, as well as his tax-free savings account (TFSA). He also has a joint investment account with his wife. Overall, Adam’s portfolio consists of a good mix of high-quality stocks, bonds and mutual funds. Along with Canada Pension Plan (CPP) and Old Age Security (OAS), these savings will become his primary income source in retirement, which in Adam’s mind, is still several years away.

As the clinic has expanded over the years with new patients, new staff and services being offered, the accumulated cash balance inside his corporation has managed to grow to a tidy sum. After paying himself and regular business expenses, Adam expects his cash reserves to continue accumulating for the foreseeable future.

What planning opportunities does Dr. Just have for his corporation’s accumulated cash?

The Corporate Insured Retirement Program (IRP) is an innovative business planning concept that provides life insurance protection plus the potential for future access to cash values that have accumulated and compounded in the policy on a tax-free basis.

Adam recognizes that one of the few remaining tax shelters available in Canada is through purchasing life insurance. Although he may not yet be convinced of the benefits of owning more life insurance, Adam’s financial advisor explains the IRP concept from a tax-effective estate and supplemental retirement income standpoint.

Life insurance is a vehicle that can play an integral role in generating income in retirement, specifically when held inside a corporation. With policy guarantees, and significant cash values that accumulate tax-free, Adam’s IRP will instantly create a sizeable estate that rivals savings in his existing portfolio.

Adam’s advisor recommends a permanent life insurance policy, where Adam can deposit lump sums of corporate cash into the IRP, within limits prescribed by the Income Tax Act. Adam can allow the IRP’s cash values to compound tax-free, with the accumulated amount becoming a valuable corporate asset.

Once the cash is deposited to the IRP, Adam can choose from a range of investment options. Since Adam’s existing retirement assets are subject to market fluctuations, his advisor recommends a more guaranteed solution. With built-in policy guarantees, these assets form part of Adam’s fixed income component of his overall retirement plan and are beyond the emotions and gyrations of the market. Adam now has a great deal of comfort and certainty as he approaches retirement.

In retirement, Adam has a few options to supplement his income stream. He may decide to begin withdrawing the cash value, subject to tax, or he may pledge his corporate IRP as collateral with a bank, in return, receiving tax-free retirement income payments.

How has Dr. Just improved his financial portfolio immediately?

As a healthy 45-year-old, Adam purchases a $250,000 corporate-owned permanent life insurance policy. He would like to pay the premiums for 15 years, so the policy is fully paid by age 60 and no further premiums will be required for the remainder of his life.

Adam has immediately increased his estate by $250,000, meaning that if Adam should pass away today, $250,000 would be payable as a tax-free lump sum to his estate (i.e., wife, children, charity, etc.) through his corporation’s capital dividend account (CDA). As he continues to fund the policy over the next 15 years, his advisor details how his estate value increases accordingly.

Cash values begin accumulating and compounding tax-free within the policy, both from guaranteed sources and attractive dividend sources. For instance, Manulife’s permanent policy declared a 6.84 per cent dividend for 2012, which has been a very predictable, low-risk dividend source at an eighth of the risk variance of the TSX stock market, and a third the variance of even the Scotia Capital universe bond index. Of note, Canada Life declared a 6.8 per cent dividend on its permanent policy for 2012.

Understanding the immediate benefits created by life insurance, and the tax-free compound growth, Adam’s financial advisor suggests he deposit $8,300 to his IRP each year. Over 15 years, that is an out-of-pocket deposit of $125,000.

What options will Dr. Just have in retirement?

Assuming Adam retires at age 65, and by pledging the policy as collateral, Adam could reasonably expect a retirement income of $14,500 per year, based on current dividend rates and life expectancy. Again, this amount is set within limits and can be attuned to more individual preferences and circumstances. Upon Adam’s eventual passing, the insurance proceeds will repay the loan, with the residual value being paid to his estate via a tax-free corporate dividend.

|

|

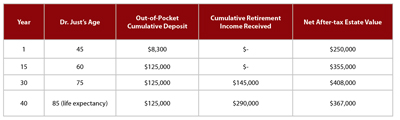

| Table source: Manulife Financial, age 45 male, non-smoker based on current dividend scale.

|

Compared to saving in an alternative fixed-income portfolio, the corporate IRP can provide significant increases in cash values, retirement income, and also sizeable estate values.

An example

Consider the following table that illustrates Adam’s projected corporate IRP strategy. This table highlights some select years with Adam’s cumulative out-of-pocket deposits, cumulative retirement income benefits, and the after-tax estate value upon Adam’s eventual passing.

In year 1, Adam’s estate has been immediately increased to $250,000 should he pass away prematurely, and he knows the amount he is required to deposit for 15 years (i.e., $8,300 per year).

At year 15, Adam has fully funded his corporate IRP with no further payments required. His after-tax estate value continues to grow based on declared dividends (i.e., $355,000).

At year 30, Adam has already enjoyed 10 years of tax-free retirement income (i.e., $145,000 cumulative, which is $14,500 per year for 10 years).

By year 40, Adam has enjoyed 20 years of tax-free retirement income (i.e., $290,000 cumulative, which is $14,500 per year for 20 years). Assuming Adam passes away at age 85, the insurance policy has repaid the outstanding collateral loan, and Adam’s after-tax estate value is $367,000, based on accumulated and declared dividends.

In Summary

Because life insurance is a contract binding the insurance company, Adam can approach the corporate IRP strategy with a high level of confidence in the amount of retirement income and net estate value he can expect in the future.

There are a wide range of applications to the IRP concept, and many features that are beyond the scope of this article. However, in light of market uncertainties, the IRP is a tax-friendly concept worthy of exploring.

Although there are tremendous benefits for an IRP to be held within a corporation, there are also many situations where an IRP can be held personally, with the same level of guarantees and many of the same tax efficiencies.

As with all financial decisions, it is best to work with an advanced team of capable advisors who are attuned to the complex legal and tax environment, and who will co-ordinate with your accountant and lawyer to ensure the IRP concept is approached accurately and specifically tailored to your individual

circumstances.

DISCLAIMER:

Canaccord Wealth Management is a division of Canaccord Genuity Corp, member-– Canadian Investor Protection Fund. Insurance products are offered through Canaccord Estate Planning Services. The views in this article are solely the work of the author, and not necessarily those of Canaccord. The information herein is drawn from sources believed to be reliable, but its accuracy and completeness is not guaranteed, nor in providing it does the author or Canaccord assume any liability.

|

Mike Magreehan is an investment advisor and Certified Financial Planner with Canaccord Wealth Management in Waterloo, Ontario. Mike welcomes your comments and questions at 1-800-495-8071 or mike.magreehan@canaccord.com. Visit www.LMwealth.com .

Print this page